Why do stocks go up and down?

I was motivated to major in Economics because I wanted to understand human behavior and how the world works. Especially things that don’t make any sense. It’s hard to find a better example than the stock market. There are hundreds of publications and TV networks and commentators that try to make sense of something that really seems to makes no sense.

But it actually does make sense. It’s just a kind of sense that’s difficult to accept especially if you’ve invested your retirement into the market.

Let’s start with things that are often cited as reasons for stocks going up or down:

- Company earnings

- News stories

- P/E ratio or other numerics

- New product introduction

- Layoffs

I could go on. But none of these directly causes a stock to go up or down. It’s easy to prove this by picking a company and looking at historical price moves based on one of the items above. It turns out that “undervalued” stocks sometimes go up and sometimes go down. Stocks rise or fall after great earnings. Layoffs have unpredictable effects. Positive or negative news can lead to an opposite price move.

With a contrary move in a stock price, you’ll hear pundits try to explain it away, but the truth is that you can’t predict it and you can’t explain it.

The simple truth on what causes a stock to be at a specific price at a specific moment is simply what price a buyer is willing to pay and a seller is willing to accept to part with their shares. If the number of shares for sale matches those that people want to buy, it’s likely the share price will be fairly stable. But it’s almost always out of balance and that’s what causes the price to move.

This is very uncomfortable to think that a stock price can move just because of the independent buying and selling decisions of millions of people. We honestly have no idea or no way of knowing what drives all these decisions.

A company can have great earnings and people can read about it and decide to buy. If they place buy orders and not enough shares are available to sell at the going rate then the price goes up to entice sellers to part with their shares. The earnings reports didn’t cause the stock to go up. It influenced people’s decisions and it tilted in favor of a higher price.

It’s a subtle but very important difference. Imagine the same earnings news is mostly ignored and instead people focus on a popular twitter posting negative information about the company. Then the stock price goes down because there are not enough buyers. There’s no direct connection between the news and the price move. If there was, it would be predictable.

On top of all the other factors, there are some really huge ones that can’t be ignored. There is automated trading that happens when stocks hit certain prices. There are mutual funds that have to buy and sell on a given day to balance out their portfolios. In this case, nothing in the news is driving these purchases.

And that’s what makes stocks go up or down.

Advanced

Robinhood, an online trading service for stocks and options, offers a wonderful view for subscribers to their Gold service that is incredibly instructive to how the stock market works.

Before I get into it, let me rant about phrases you’ll hear often in financial reporting like “there were more sellers than buyers today” as an explanation for a stock going down.

The truth is that on the other end of every buyer is one or more sellers. Same goes for there being one or more buyers for every seller. So, technically there can be more buyers than sellers but only because people are buying different quantities of shares.

For example, if I want to buy 100 shares, I might be matched up with 2 sellers that each have 50 shares to sell. If you sum up all the transactions in a day, the number of buyers and sellers will be close to balance.

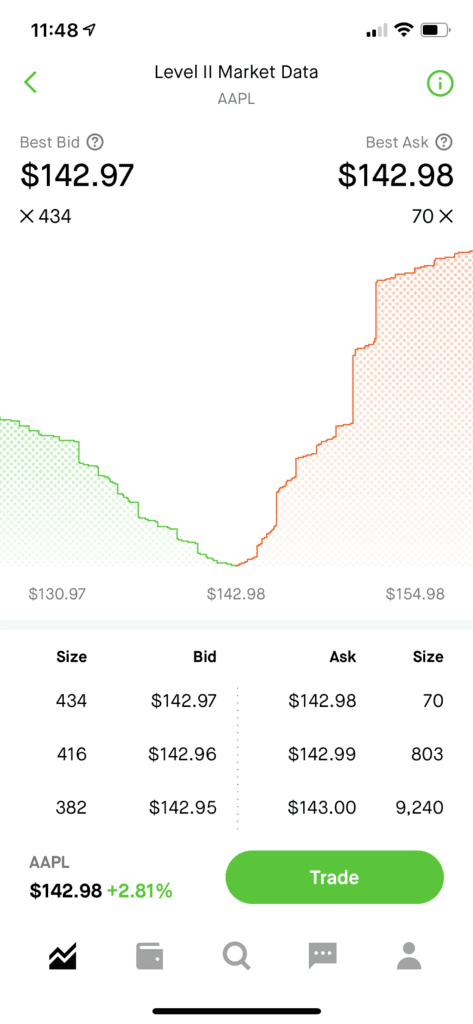

Back to Robinhood. Here’s this view I was talking about:

At the left in green are buyers and the prices they are willing to pay for Apple stock. The height of the line indicates the cumulative dollar value of these intended purchases. The price they are willing to pay is call the “bid” price.

On the right is the same thing but from a seller’s perspective. The price at which they are willing to sell is called the “ask” price”

As you can see, the sell side goes higher than the buy side. This means the stock will meet some “resistance” as it tries to move higher. There are a couple of vertical portions that are prices like 145 and 150. This is because some people like to use round numbers. When the stock gets near those prices, it will have some difficulty jumping over them.

On the buy side, there is small vertical line that might indicate buy orders placed at the even number of 130.

The meat

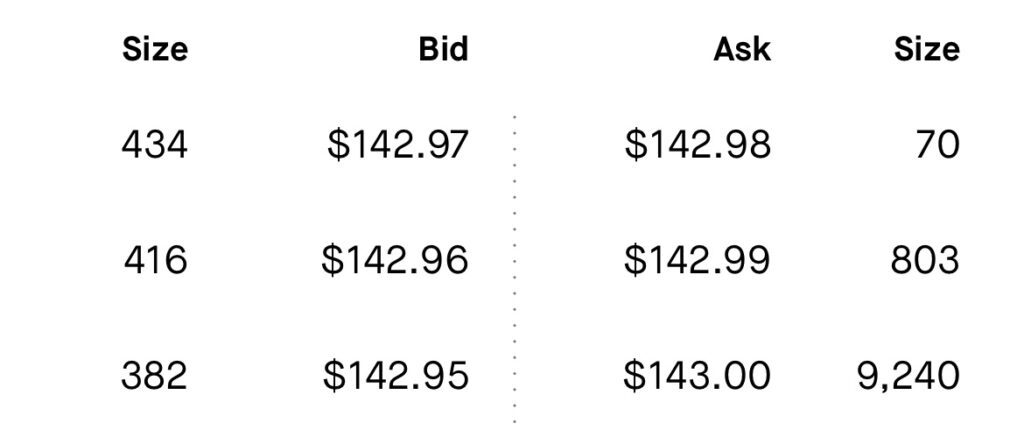

The most interesting part is the list of bids and asks at the bottom. They are arranged in order of price, with the highest bid (buy) prices at the top and lowest ask (sell) prices at the top. It also shows the number of shares.

I’ll walk through the first few trades and the rest should hopefully make sense. First, we have:

- Bid for 434 shares at 142.97

- Ask for 70 shares at 142.98

In this case, 70 shares are sold to the first buyer at a price between the bid and ask price. In this case, they are virtually the same, so the sale will end up being 142.97 or 142.98 – whatever it ends up being, the stock price will move to match that price. Let’s presume the price was 142.97—depending on the current price of the stock, this new price will be reflected in a higher or lower price for the stock. This is what makes stocks go up and down!

Let’s go further. At this point, we have:

- Bid for 364 shares at 142.97 (remember there was a 70 share transaction)

- Ask for 803 shares at 142.99

At this point, the buyer finds enough shares from the next seller to complete her buy. The price she wanted was 142.97 and the seller wanted 142.99, so they probably split the difference and the sale is at 142.98—now the stock goes up by 1 cent from the previous transaction.

Hundreds or thousands of transactions like this are happening every day. Depending on the prices that buyers and sellers want and what they agree on, the price goes up or down.

Once again, that’s what makes stocks go up or down.